2023 Audited 990-PF (Tax Return) & Financial Statements

Transparency is one of our core values at ARDC. Thus it’s important to us that, every year, we take some time to walk through our audited financials, and to do our best to make sure they are understandable by everyone – including people who do not spend their days analyzing 990s. With this in mind, we are pleased to share the results of our completed 2023 audit, conducted by AAFCPAs. You can now find our 2023 audited 990-PF (tax return) and financial statements at https://www.ardc.net/about/legal/ardc-finances/.

Transparency is one of our core values at ARDC. Thus it’s important to us that, every year, we take some time to walk through our audited financials, and to do our best to make sure they are understandable by everyone – including people who do not spend their days analyzing 990s. With this in mind, we are pleased to share the results of our completed 2023 audit, conducted by AAFCPAs. You can now find our 2023 audited 990-PF (tax return) and financial statements at https://www.ardc.net/about/legal/ardc-finances/.

Cash vs. Accrual

As you look at some of the comparisons below, you’ll see some items listed as cash and some as accrual.

- Accrual totals show expenses approved in a given year (such as an invoice received from a vendor or an approved grant). Ideally, these liabilities get paid within the same year that they were approved, though some may be paid in the following year.

- Cash totals show expenses that were actually paid in a given year. When the IRS calculates our required minimum 5% distribution, they are looking at these numbers.

- The 990-PF shows both cash and accrual totals, while the financial statements primarily show accrual totals in their analysis.

Grants & Gifts

After the 2021 stock market boom, followed by the 2022 stock market bust, ARDC’s assets landed somewhere in the middle at the end of 2023. As a result, our minimum 5% distribution also landed somewhere in the middle (please see the below section outlining our Qualifying Distribution Balance for more details). This market activity influenced our spending on grants and gifts in 2023.

| Year | Grants & Gifts (Accrual) | Grants & Gifts (Cash) |

| 2023 | $6,345,764 | $5,880,342 |

| 2022 | $6,904,678 | $8,004,191 |

| 2021 | $10,798,573 | $9,247,203 |

| 2020 | $3,155,532 | $3,004,625 |

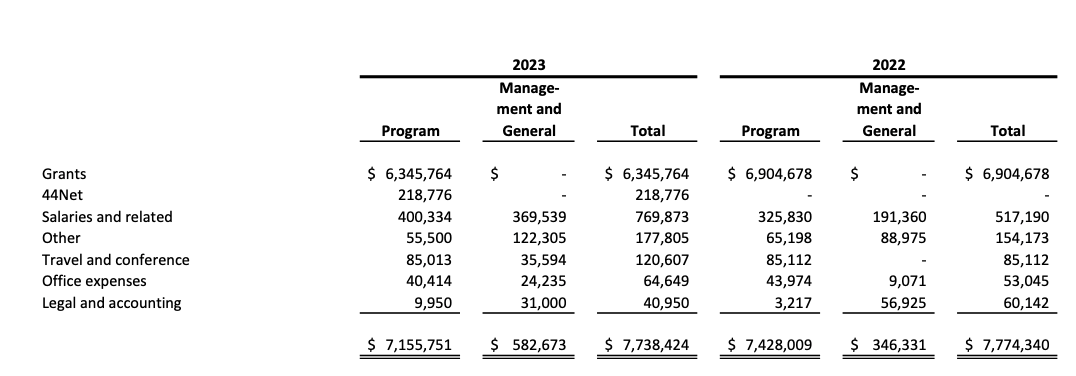

Statement of Functional Expenses

Functional expenses are how the IRS looks at nonprofit expenses overall, separating the program expenses (directly related to carrying out our programs) from management and administration.

Statement of Functional Expenses, which can be seen in text format on Page 5 of our 2023 Financial Statements

Looking at this view of our finances, you can see how different parts of our expenses directly serve our programs (44Net as well as Grants and Gifts) versus general administrative overhead. This view also provides a comparison to the previous year so that the public can see changes between years.

In terms of year-to-year changes, this view shows some increased spending in the Salaries and Related category, primarily due to the addition of a staff member who started in late 2022. We also called out expenses for our yearly in-person Staff + Board meeting in the Travel and Conference category, which had been lumped into the Other category in previous years.

One big difference for 2023 is that we created a new category specifically for 44Net. Though in prior years these expenses were lumped into the Other and Office Expenses categories, we are beginning the practice of making these important program expense totals explicit.

Speaking of Other and Office Expenses – these are categories that, frankly, we don’t love. That said, they are standard categories used for these kinds of financial reporting purposes. We have thus learned to accept them – and also to be sure to provide some insight into their composition. The biggest expenses in Other include our employee benefits like QSEHRA (a healthcare reimbursement program), as well as development fees for Hypha, the open source grantmaking software we use at grants.ardc.net. It also includes fees for insurance, banking, and similar miscellaneous items. The largest expenses in the Office Expenses category include fees for IT professional services, servers, and software that we use internally (e.g. Quickbooks and Zoom).

Total Expenses: 990-PF

Another way of looking at our expenses in 2023 is to look at the total expenses versus the grants paid as outlined in Part I of the 990-PF. Note that program expenses for 44Net are included in Operating Expenses.

| Accrual | Cash | |

| Operating Expenses | $1,447,451 | $1,393,094 |

| Contributions, Gifts, Grants Paid | $6,345,764 | $5,880,342 |

| Total Expenses & Contributions | $7,793,215 | $7,273,436 |

Beginning-of-Year vs. End-of-Year vs. Average Assets

Part II of the 990-PF outlines our balance sheets, which show our total assets and liabilities at the beginning and end of the year:

- Beginning-of-year: $107,895,897

- End-of-year: $117,236,719

Our month-by-month average assets are used to determine our required distribution for the year. In 2023, our average assets were $113,069,581 (see Part IX of the 990-PF).

Qualifying Distribution Balance

So where does all of this leave us in terms of our required 5% distribution balance? This information is outlined in Parts IX, X, XI, and XII of the 990-PF.

- Parts IX and X calculate the amount of our qualifying distribution (5% of our average assets minus fees like our 2023 income taxes),

- Part XI lists the qualifying distribution (same amount as the cash total of expenses in Part I), and

- Part XII outlines our remaining distributions from prior years, our minimum distribution amount for 2023, and the remainder based on our 2023 qualifying distribution. Since we spent more than required, this remainder will be carried over toward our 2024 distribution.

Here is the excess distribution calculation for 2023:

| 2023 Minimum Distribution: | $5,618,959 |

| 2023 Qualifying Distribution: | $7,273,436 |

| 2023 Excess Distribution: | $1,654,477 |

And here is how this excess distribution affects our total excess distribution:

| 2021 Excess Distribution | $486,289 |

| 2022 Excess Distribution | $3,093,019 |

| 2023 Excess Distribution | $1,654,477 |

| Total Excess Distribution | $5,233,785 |

It’s worth noting that we like having some excess distribution on the books. That said, we were in agreement going into 2024 that we aim to curb our spending in coming years in order to draw it down. Our goal, as always, is to maintain our endowment for the long term so that we can sustain our ability to continue our mission, despite the forces of inflation and market fluctuations.

Another Brief Note

This blog post is going out much later in the year than intended. This is a direct result of sudden understaffing earlier this year, which dominoed into a number of organizational delays. One of those delays was our tax filing, which we got in just before the extension deadline (Nov. 15). Our hope is that next year we are able to file by or closer to the regular deadline (May 15), so that we can share our finances with the public in a more timely fashion. Thank you for your patience!

Got questions about our 990-PF or Financial Statements? Just ask!

Please direct any questions to contact@ardc.net.